AT A GLANCE

- Massive herd expansion helps fuel surge in trading

- Analyst: Feedlots are in as good a position as they’ve been in years

Beef producers are building the U.S. cattle herd at one of the fastest paces on record, as higher cattle prices and stronger exports fuel healthy profit margins. The expansion comes just a few years after the U.S. herd shrank to a six-decade low amid severe drought in the Southern U.S. Plains and near-record corn prices.

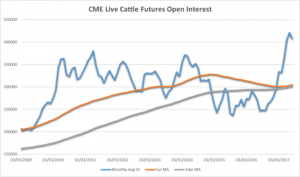

The market resurgence is reflected in CME Group’s benchmark Live Cattle futures contract, for which the number of open positions, or open interest, has reached all-time highs.

CME’s 10 highest-ever daily open interest figures for Live Cattle futures (the contract was launched in 1964) have been posted since late April, topped by 431,718 contracts at the close of trading May 2. Live cattle open interest averaged 407,800 contracts during June 2017, up 33 percent from the five-year average.

Market professionals keep a close eye on open interest – the number of “open” or outstanding positions in a given day – as a gauge of liquidity and who’s doing what. It reveals when new buyers and sellers are entering or exiting the market.“Open interest allows us to verify the flow of money into our markets,” says Alan Smith, Director of Protein Research and Risk Management for CattleFax.

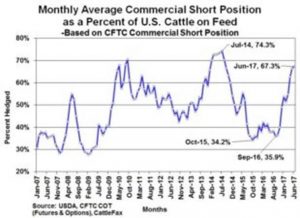

“Cattle futures are a vital risk management tool for both cattle producers and beef processors. Both types of entities are looking to lay off risk in a very capital intensive business,” he says. According to USDA and CFTC data, more than 67 percent of U.S. cattle were hedged in June, compared to just 36 percent last September. Increasing open interest often represents additional hedging activity or investment coming into a particular market, whereas decreasing open interest indicates the opposite.

A “Dynamic” Move

Rising open interest “shows that the trading public – commercials as well as speculators – have confidence in the market and are willing to use the instrument for hedging or trading needs,” says Tony Drake, Senior Director of Agricultural Products at CME Group. “Open interest patterns can show us a larger story on what the trading public thinks.”

In late 2016, index fund traders started buying cattle futures as part of “rebalancing” their portfolios against other commodities, such as oil, gold and grain. Managed funds added long positions as the market’s rally triggered technical buy signals. Meanwhile, cash market buyers – meat processors, primarily – took long positions as the number of slaughter-ready animals available was lower than expected.

These factors combined to catalyze “a pretty dynamic move” in the cattle market, propelling the surge in open interest, says Drake, who manages CME’s portfolio of livestock products. Cattle producers “surprised everyone” and didn’t place as many young animals in their feedlots, he says. “So the market really took off.”

CME cattle futures were up 3.7 percent over the 12 months that ended June 30, touching a 13-month high of $1.37 a pound on April 27, based on the front-month contract.

More Cattle, More Risk

With domestic production of beef, as well as pork and poultry increasing, export market strength must continue to help absorb the coming supply, Drake says, noting the recent announcement that China would end a ban on U.S. beef that was initially imposed in 2003 amid mad-cow disease concerns. Meantime, feedlot operators appear poised to keep their gates open. On June 1, the number of animals being fattened for slaughter in major U.S. cattle states totaled 11.09 million, up 3 percent from a year earlier and the largest number for that date since 2007, according to the USDA. It makes sense that interest in using futures would be up, says Drake.

“You’ve got more cattle out there, you’ve got more risk and more people using the futures.”

Feedlots Back in the Black

On the primary U.S. Plains cash markets, meatpackers paid $1.18 to $1.19 a pound for slaughter-ready cattle during the last week of June, compared to the $1 to $1.05 feedlot operators needed to break even, according to John Nalivka, owner and president of Sterling Marketing Inc., a Vale, Oregon-based consultant.

“The feedlot is in a good a position as it’s been in quite a few years,” Nalivka says. He sees continuing expansion of the herd into 2018, albeit at a slower pace.

Cassandra Fish, an Omaha-based beef industry expert who runs The Beef blog, says market conditions have encouraged more activity from both speculators – who’ve been more inclined to “roll” futures positions ahead, month after month – and producers, who have more cattle to hedge. “We’ve seen lots of hedging by producers,” Fish says. “That’s contributed to part of the open interest build. The feeder has been laying off risk.” Fish also sees expansion continuing. She projected the total U.S. cattle herd will rise to 94.4 million head on January 1, 2018, up almost 1 percent from 93.5 million on the same date in 2017. Herd expansion “really reflects the breaking of the drought,” she says. “We severely reduced the herd. It’s been a very rapid expansion, one of the fastest in history. We are definitely looking at larger beef production next year.”

Written by: