The Leap to a Multi-Broker, Multi-Asset Platform

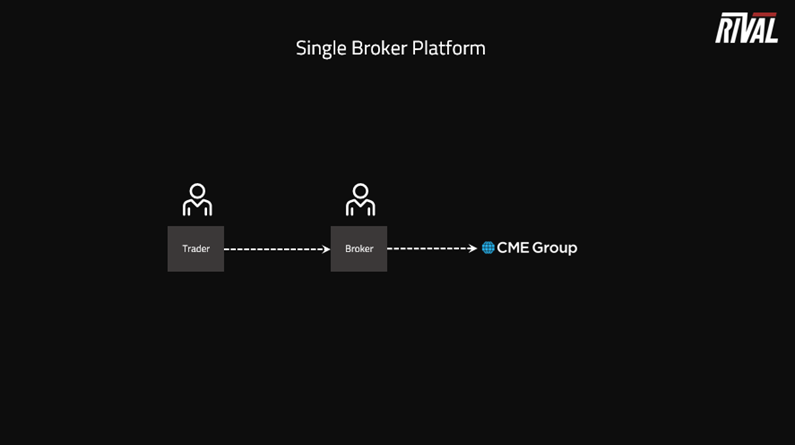

You've proven your strategy, and your business is taking off. But now, you want to expand into other asset classes or exchanges. Your broker only supports futures, but you want to trade equities, options, and maybe even crypto.

You also want the ability to run an auto-spreader to trade the relationship between the different products and exchanges and run algos to improve your execution levels. Your broker's platform can't meet your needs, so you search for a multi-broker platform.

The Leap to a Multi-Broker, Multi-Asset Platform

You've proven your strategy, and your business is taking off. But now, you want to expand into other asset classes or exchanges. Your broker only supports futures, but you want to trade equities, options, and maybe even crypto.

You also want the ability to run an auto-spreader to trade the relationship between the different products and exchanges and run algos to improve your execution levels. Your broker's platform can't meet your needs, so you search for a multi-broker platform.

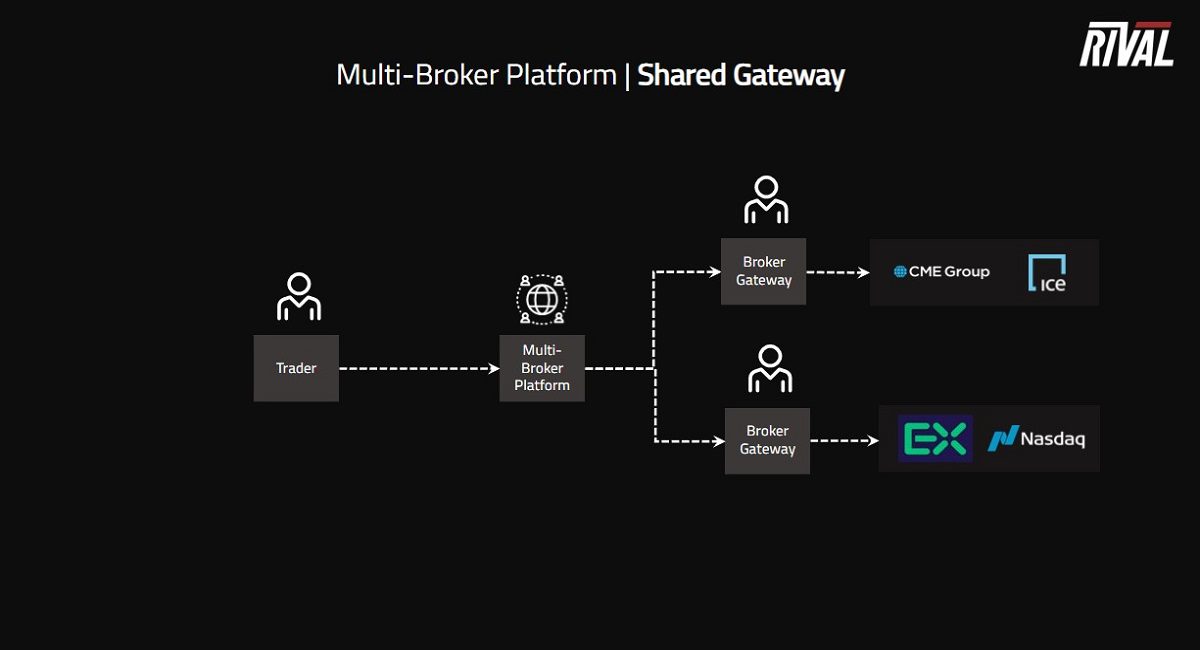

With the multi-broker platform, you get the features you’re looking for, you have the flexibility of using different brokers, but the platform only allows you to trade via a shared gateway. Everyone’s orders are routed through the same exchange connection, so your orders are stuck behind everyone else trying to get to the exchange.

You try running the spreader but keep getting hung on your hedge leg because the system is too slow. You need to switch to a platform that allows you to run with Direct Market Access (DMA).

Optimizing Performance with DMA

With the multi-broker platform, you get the features you’re looking for, you have the flexibility of using different brokers, but the platform only allows you to trade via a shared gateway. Everyone’s orders are routed through the same exchange connection, so your orders are stuck behind everyone else trying to get to the exchange.

You try running the spreader but keep getting hung on your hedge leg because the system is too slow. You need to switch to a platform that allows you to run with Direct Market Access (DMA).

Optimizing Performance with DMA

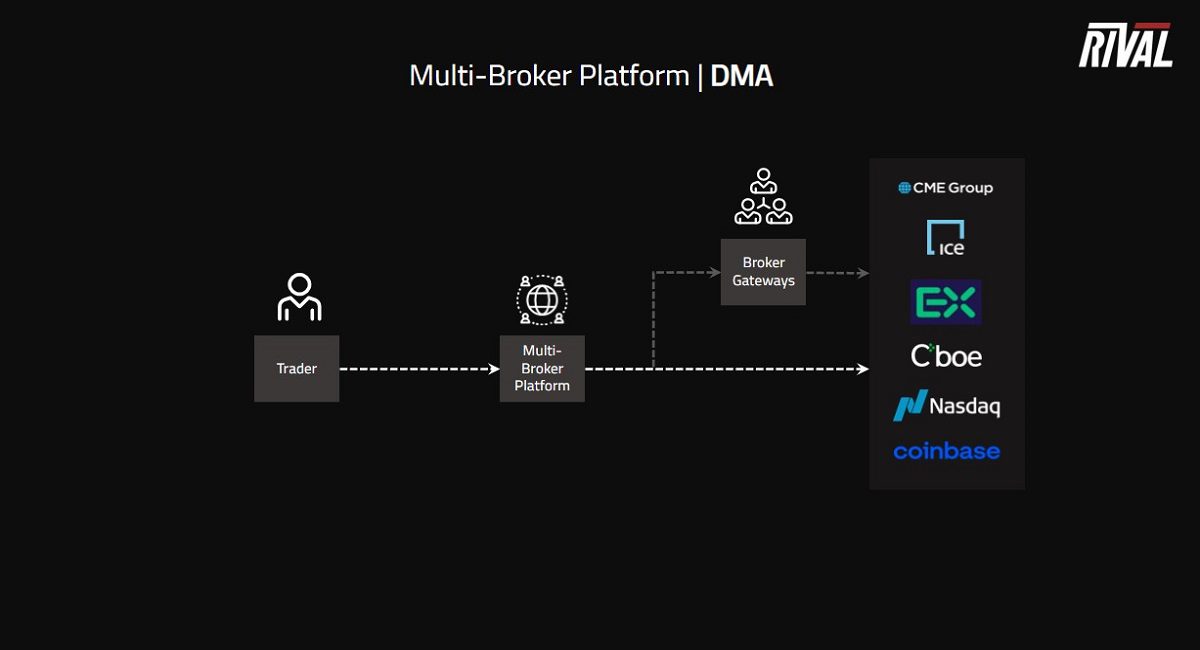

You switch to a platform allowing you to route your equity orders to a broker gateway. Your futures and crypto orders are sent directly to the exchange using a dedicated gateway and exchange connection on a server collocated at the exchange. As a result, you can trade multiple asset classes, effectively spread across products and exchanges, and your business starts to take off.

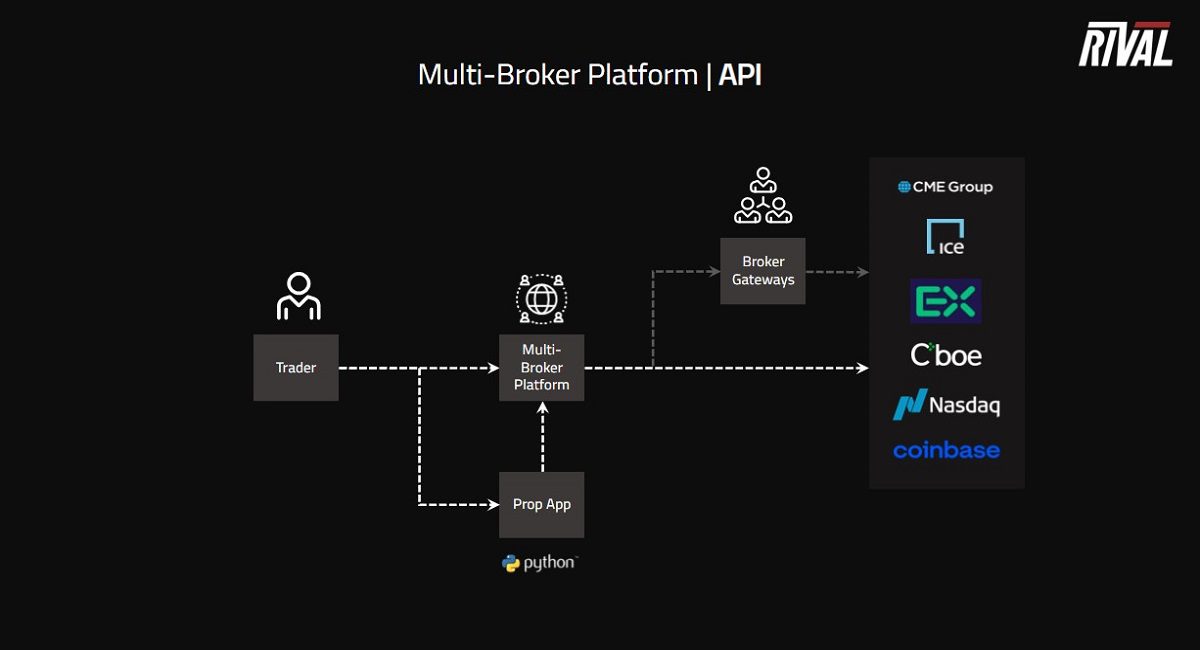

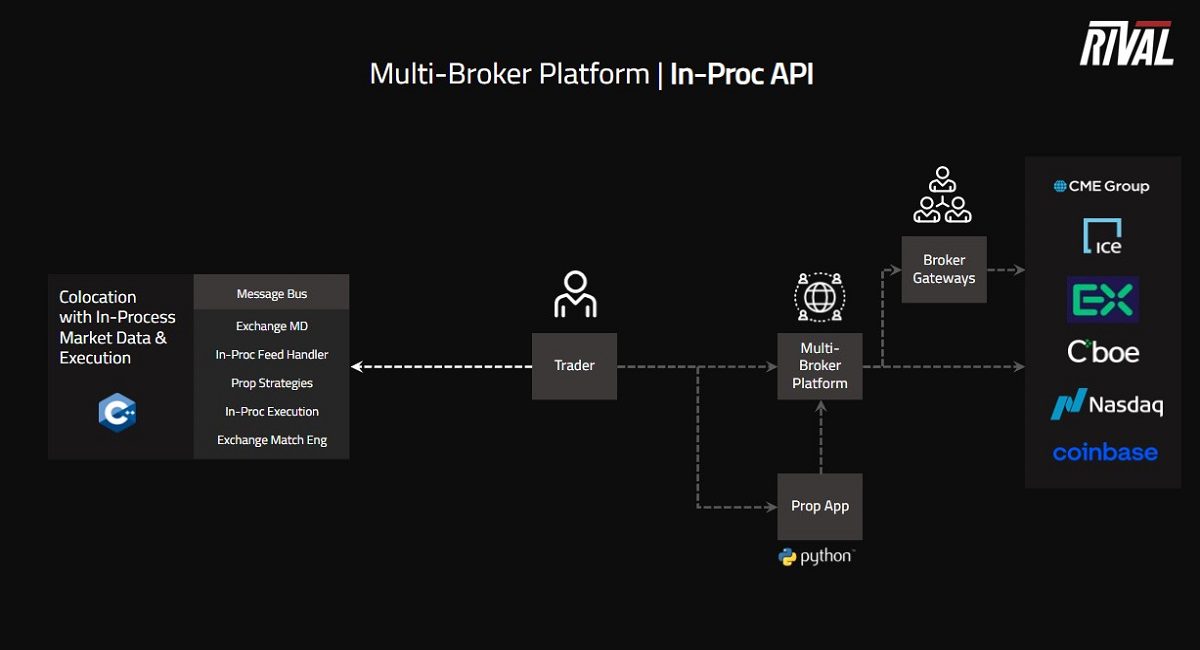

Automating Your Strategies with API

You want to scale your business further by automating some trading strategies. You’re just trying to replicate what you’re doing manually, so you don’t think latency is that critical. You hire a developer to use the multi-broker platform’s C# or Python API to build your strategy.

You switch to a platform allowing you to route your equity orders to a broker gateway. Your futures and crypto orders are sent directly to the exchange using a dedicated gateway and exchange connection on a server collocated at the exchange. As a result, you can trade multiple asset classes, effectively spread across products and exchanges, and your business starts to take off.

Automating Your Strategies with API

You want to scale your business further by automating some trading strategies. You’re just trying to replicate what you’re doing manually, so you don’t think latency is that critical. You hire a developer to use the multi-broker platform’s C# or Python API to build your strategy.

Your proprietary application runs on a desktop or server in your office.

Your proprietary application runs on a desktop or server in your office.

- Market data is normalized and sent over the network to your application.

- Your application receives the market data, performs various calculations, and sends the order through the network back to the trading platform.

- The trading platform’s gateway receives and routes the order to the exchange.

For high-frequency or algorithmic traders, speed and performance optimization is everything. You need single-digit micro-second latency if you want to compete. You must work with a multi-broker platform offering a C++ API with an in-process market data feed handler and execution gateway. In this scenario, your proprietary strategy:

For high-frequency or algorithmic traders, speed and performance optimization is everything. You need single-digit micro-second latency if you want to compete. You must work with a multi-broker platform offering a C++ API with an in-process market data feed handler and execution gateway. In this scenario, your proprietary strategy:

- Runs on a dedicated server collocated at the exchange.

- Raw market data hits your server and is normalized by the in-process feed handler.

- Your strategy receives a call back with every market data update, and you run your proprietary calculations.

- The in-process gateway normalizes your order, pre-trade risk checks are run, and the order is sent directly to the exchange.

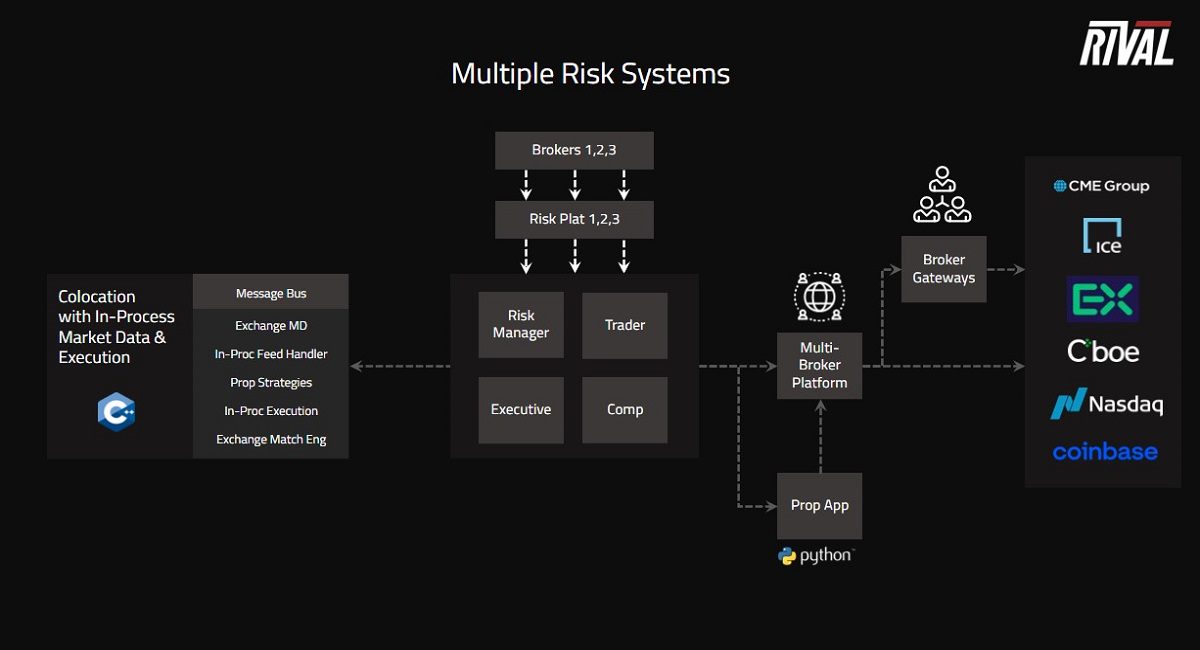

When you have one broker and one trading platform, you typically use the broker's risk management tools. It's great for a few accounts, but when you start trading more accounts across multiple brokers, trading platforms, and asset classes, things get messy.

You don't have a consolidated view of your risk if you run multiple trading platforms across multiple brokers. You must run three separate risk systems, which becomes an operational nightmare that hinders your ability to scale.

A Consolidated Risk Platform

You bite the bullet and buy an enterprise risk platform that consolidates the positions and trades across all your accounts. You can finally see real-time firm P&L and margin across futures, equities, and options and set up alerts so you don’t have to sit and watch the screen all day.

You can run VaR across your strategies to assess the combined risk and run user-defined scenarios to shock the market and volatility. And on top of that, the system automatically calculates the volatility, theos, and Greeks based on the market to give you an unbiased view of your risk.

When you have one broker and one trading platform, you typically use the broker's risk management tools. It's great for a few accounts, but when you start trading more accounts across multiple brokers, trading platforms, and asset classes, things get messy.

You don't have a consolidated view of your risk if you run multiple trading platforms across multiple brokers. You must run three separate risk systems, which becomes an operational nightmare that hinders your ability to scale.

A Consolidated Risk Platform

You bite the bullet and buy an enterprise risk platform that consolidates the positions and trades across all your accounts. You can finally see real-time firm P&L and margin across futures, equities, and options and set up alerts so you don’t have to sit and watch the screen all day.

You can run VaR across your strategies to assess the combined risk and run user-defined scenarios to shock the market and volatility. And on top of that, the system automatically calculates the volatility, theos, and Greeks based on the market to give you an unbiased view of your risk.

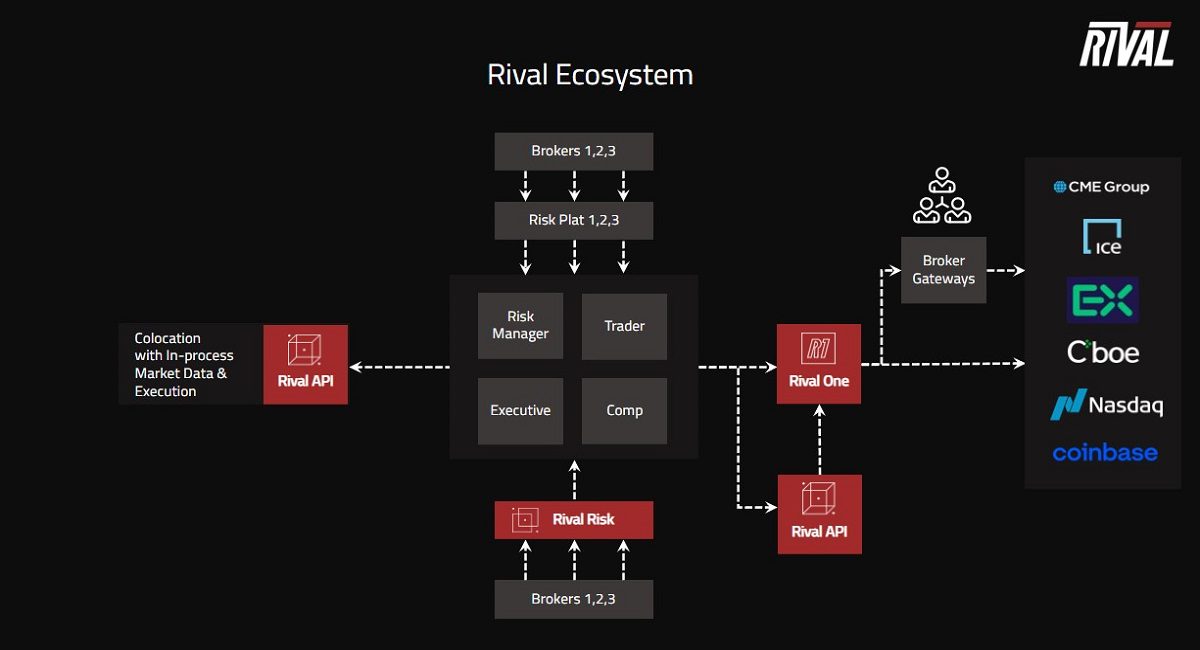

Choosing an All-Encompassing Platform

We've examined the ever-evolving needs of the trader. So why not select a platform with all the necessary features that cover multiple brokers, exchanges, and asset classes now instead of spending the next several years wading through a patchwork of platforms?

Rival One allows traders to trade futures, stocks, options, and crypto through multiple brokers or direct connections to futures and crypto exchanges with a low latency auto-spreader and advanced algos. In addition, you can route orders to a shared or dedicated gateway with servers collocated at each exchange.

Leverage the Rival API to quickly build C# or Python applications to subscribe to our normalized market data feed and send orders to our gateway. If latency is critical, leverage our C++ in-process feed handlers and execution gateways running in our cage or yours.

Rival Risk unifies and integrates the risk management process, so you have 360-degree insights across all accounts no matter how many front ends your firm uses. Rival Risk also calculates real-time margins across forty different exchanges. With our proprietary covariance matrix, you can calculate Value at Risk across all their accounts or run custom price and volatility scenarios.

Learn More About Rival Systems Integrated Multi-Broker, Multi-Asset Solutions at Rival Systems.

Choosing an All-Encompassing Platform

We've examined the ever-evolving needs of the trader. So why not select a platform with all the necessary features that cover multiple brokers, exchanges, and asset classes now instead of spending the next several years wading through a patchwork of platforms?

Rival One allows traders to trade futures, stocks, options, and crypto through multiple brokers or direct connections to futures and crypto exchanges with a low latency auto-spreader and advanced algos. In addition, you can route orders to a shared or dedicated gateway with servers collocated at each exchange.

Leverage the Rival API to quickly build C# or Python applications to subscribe to our normalized market data feed and send orders to our gateway. If latency is critical, leverage our C++ in-process feed handlers and execution gateways running in our cage or yours.

Rival Risk unifies and integrates the risk management process, so you have 360-degree insights across all accounts no matter how many front ends your firm uses. Rival Risk also calculates real-time margins across forty different exchanges. With our proprietary covariance matrix, you can calculate Value at Risk across all their accounts or run custom price and volatility scenarios.

Learn More About Rival Systems Integrated Multi-Broker, Multi-Asset Solutions at Rival Systems.